This is very LATE and I was determined to finish my 2021 end of year review before Chinese New Year 🤣 but I just missed it! Happy Lunar New Year, everyone – May you attain greater wealth (Gong Xi Fa Cai!)

This is a privilege of those of us who celebrate two new years! You always get a second chance if you miss the deadline for Jan 1. I’m a late starter in other areas too, sigh!

Let’s recap what my goals were for 2021 –

1. Create another income stream

2. Invest $30000 into my shares portfolio

3. Lose 10kg

4. Be semi self sufficient in vegetables

And a reminder of what my decade (2020 to 2029) goals are –

1. Retire at 55

2. Visit Antarctica

3. Run a marathon

So, without further ado, what happened in 2021 and what was my progress with these goals?

Feeling Overwhelmed?

Use this FREE Checklist to start your journey to Financial Independence

Goal 1 - Create another income stream

My reliance on a full time job to provide an income was really highlighted by the pandemic.

I’ve had stressful roles pre pandemic and been burnt out. But now I can experience burn out plus be infected by a deadly virus. Yay!

My healthcare job is 10 times more stressful now than ever before. I don’t have the luxury of working from home. Although our workload has increased dramatically, our revenue hasn’t. So it’s not as if we can ask for a pay rise. There is no extra money for all the extra stress.

This has been going on since 2020 – learning how to keep everyone safe, managing staff and public anxiety, implementing policies on the run, trying to access stock etc. Working was stressful and mentally draining. I slept a lot, read a lot and ate a lot of chips in 2020.

2021 was supposed to be better. It wasn’t. We endured lockdown after lockdown – 4 in total. Work alternated between really quiet (when I’d worry about being laid off) to really hectic (when I’d question if I could last another five years in the job).

We started administering Covid 19 vaccinations in August. The rules changed. All. The. Time. Needless to say, the public was confused with the messaging and what to do. We had to deal with the fall out – which included tears and rants. Some were excited of course but we copped a lot of angry people who were unhappy that they had to be double vaccinated to get a haircut.

Before the pandemic, I never questioned my reliance on my job to provide an income. But now I was nervous.

So I felt the need to create other income streams, just in case I can’t handle the job anymore or I am made redundant because of the reduced revenue.

In 2021, my other income streams are:

1. Dividends

2. Interest

3. Octopus Group Surveys

4. Cashrewards

5. Blog

1. Dividends

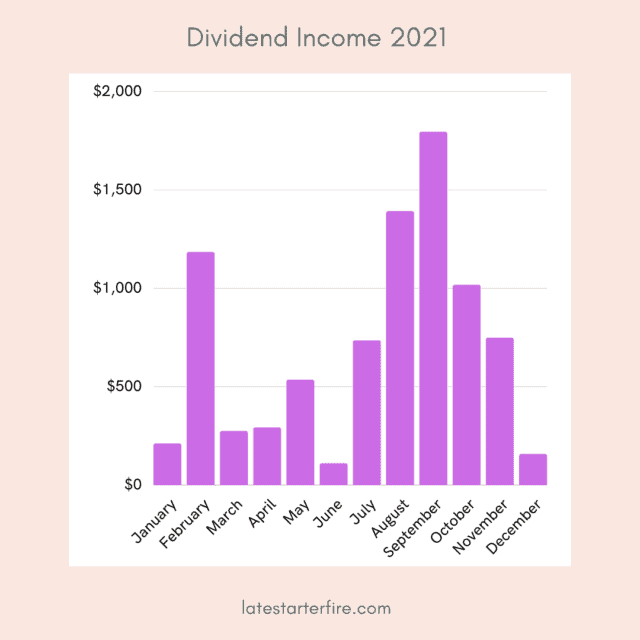

I had never tracked my dividends before 2021 so I was pleasantly surprised with the result. Now I look forward to charting them every month. Hang out with me on Instagram – I post my dividend income and other progress reports monthly.

The majority of my dividends are automatically reinvested and this is how I grow my portfolio on a set and forget basis, besides investing on a regular basis.

My total dividends in 2021 amounted to $8447 which was a 68% increase on what I received in 2020.

My dividend income is by far the best additional income stream I’ve created. And did I mention that it is truly passive?

2. Interest

My various sinking funds, in particular my emergency fund and travel fund earned a paltry total of $185 in 2021. I anticipate this stream will dry up in 2022 as I start to use my travel fund and rebuild my emergency fund.

3. Octopus Group Survey

4. Cashrewards

I use Cashrewards (affiliate link), a cash back site whenever I can. I most certainly do not want to rely on this ‘income stream’ 🤣 as it means I’m spending. But if I HAD to spend money, then I do it via the cash back site if possible and earn some cash.

And 2021 was an epic year of spending which I’ll come to later. Not all my major appliances were bought via the site as I received a better discount by going to the retailer directly in some cases.

I cashed out $95 in 2021. Once again this went to my Antarctica fund.

5. Blog

Spending time on this blog is my major creative outlet. I definitely did not set out to earn money from blogging. 2021 taught me that I can help people and earn some money. The two are not mutually exclusive.

But trying to monetise the blog is a steep learning curve and there is so much I don’t know how to do.

So this year’s expenses also skyrocketed – in purchasing courses, memberships and Masterminds. But I have learned so much in the process – mainly about myself, truth be told – that I can figure things out, that I can be too hard on myself (nothing new here!) and that I love learning new skills, helping others in the same boat and meeting others in the personal finance and blogging space.

In 2021, my blog income covered 21% of my blog expenses. I did not make use of every single course I bought so I may have to be stricter with myself in 2022.

So for the goal of creating extra income streams in 2021, I would say that I am now a lot more aware of increasing income versus decreasing expenses. And really appreciate the passive nature of earning dividends from my shares portfolio.

Goal 2 - Invest $30000 in my shares portfolio

Done and dusted, yay! Achieved this goal on Dec 14, just in the nick of time 🤣

Sometime during the year, I simplified my system and I am so much happier with it. Instead of waiting a few months till I’d saved $5000 to invest, I now invest every 4 weeks. The whole process is automated via Pearler’s (affiliate link) autoinvest function so I don’t have to think about it.

I was predicting that I’d reach Coast FI within the first 6 months of the year so I reduced how much I salary sacrificed into superannuation (retirement account). And used the extra cash after tax to invest in my shares portfolio.

I need this portfolio to fund living expenses for the 5 years (from 55 to 60) before I can access superannuation. That is, when I retire at 55 (decade goal!)

Goal 3 - Lose 10kg

My coping mechanism has been eating chips on the couch after work, especially in 2020. This meant I stacked on the weight – menopause and pandemic eating do not go well together!

In my Mid Year Review, I had lost 6kg, mainly by intermittent fasting and trying to stick to 800 calories a day.

Well, by the end of the year, after feasting at Christmas and joining my visiting relatives for daily mini feats in December meant that I’d put on 1kg. So for the record, I lost 5kg in 2021.

This tells me that I can do it but I just need to be more disciplined about portion sizes and snacking. I also need to find another way to de-stress besides eating chips on the couch.

Goal 4 - Be semi self sufficient in vegetables

This was a big FAIL.

I wanted to be perfect – and grow my vegetables from seeds instead of purchasing seedlings. It is definitely more frugal and the “correct” way.

But my timing was really off. With all the lockdowns, either the nurseries were not open or they were open at reduced hours and I couldn’t get there during those hours because of my job.

So I was mostly late in planting the seeds and the commitment of caring for them was another story. The birds and snails had a good feast when I finally planted them in the veggie boxes. But because I wasn’t monitoring them religiously, it was too late by the time I realised.

There were some successes but by and large, it was a disappointing year of growing vegetables.

Once the final lockdown was lifted, I paid for a garden consultant to come and look at my garden. So I now have a plan for a productive garden which I’ll implement in 2022.

2021 Annual Expenses

2021 was a whopper of a year in spending!

My annual expenses was 61% more than that in 2020. Yes, you read that right!

2020 was the all time lowest annual expenses since I started tracking my expenses in 2018 while 2021 was the all time high.

So what did I spend my money on?

The top 5 categories make up 73.4% of the expenses and they are:

1. Home maintenance 32.7%

2. Food 11.4%

3. Blog 11.3%

4. Financial 10.1%

5. Medical 7.9%

1. Home maintenance 32.7%

Let’s address home maintenance first as this was one third of my annual expenses.

Because of lockdowns in 2020, the installation of my ceiling insulation was delayed until 2021. I’m fervently hoping that this will reduce my future electricity and gas bills.

In December 2020, a pipe burst under the kitchen sink, resulting in water damage of my timber floor boards. There was a lot of argy bargy with the insurance company, whose own contractors could not agree on how to repair the damage. In the end, they gave me a pay out. I used the payout to find another contractor to repair my floor and saved some money in the process. The savings came in handy later.

While they were repairing the floor, I noticed that my windows were looking derelict which I guess made sense as I hadn’t maintained them for the entire time I’ve lived here. So just before Christmas, I had the outside of all windows and doors repainted.

Nearly every major appliance broke down in 2021 – the dishwasher (which I’m sure caused the burst pipe in the first place), washing machine, microwave and oven. All of them either came with the house or I bought them when I moved in about 20 years ago. I chose to purchase new items as I want them to last for the next twenty years.

I do have a home maintenane sinking fund as I realised in late 2020 that most of my appliances were dying. But in the end, I had to use my emergency fund to pay for some of the expenses.

I’m hoping that 2022 will be kinder in this category.

2. Food 11.4%

Food, glorious food.

What can I say? I enjoy good food. This does include buying food for my parents during some of the lockdowns and entertaining in between lockdowns. It was too hard to categorise them differently so I just lumped it all as food. It doesn’t include takeaways or eating out – that is an additional 1.1%

Fresh food has certainly increased in price during the pandemic. Ginger was at a crazy $69.99 per kilogram recently.

3. Blog 11.3%

As explained earlier, I bought courses, memberships and Masterminds to learn new skills and learn what I need in order to grow this blog. Since I haven’t travelled for two years, I ‘borrowed’ from my Travel sinking fund.

4. Financial 10.1%

This is a mix of insurances for the home as well as fees for professional associations, registrations etc for my work. Until I retire, there is not much I can do about the expenses associated with work.

5. Medical 7.9%

I’ve never spent so much for my health.

I had a medical procedure in a private hospital in May – there was an excess plus other out of pocket costs such as pathology and specialist fees.

My right shoulder has been painful but I ignored it for many months during lockdowns. Now I need regular remedial massages and osteopath treatments to fix it, sigh.

I also had a few sessions with a psychologist – to get over the trauma and stress of working through 2020. I’m so glad I did because she explained about compassion fatigue and how we need to take care of ourselves first before we can help others.

When I add up annual expenses for 2020 and 2021 and divide by 2 – it is still the average of what I think my annual expenses in retirement would be. And that’s what I’ve calculated in my FIRE number.

So I am not too concerned about the extra expenses for now.

Progress towards early retirement

By the end of 2021, my net worth had increased by 26% compared to 2020 so I am progressing very well towards FIRE. I do not include the value of my home in this figure as I don’t plan on selling it. It does include my superannuation balance which I can’t access until I turn 60.

Lessons learnt in 2021 (in no particular order)

The pandemic is not over yet. Everyone predicted that 2021 would be better than 2020. It turned out that we endured more lockdowns and restrictions and still could not travel or see our loved ones for most of the year.

And when we did meet up face to face with friends and family, it was so much more appreciated and precious. The 3 days of enforced isolation with my 6 year old niece in December (visiting from overseas and hadn’t seen face to face for two years) was priceless.

I learned that i was resilient but that I need to look after myself too.

After reading I Will Teach You To Be Rich, I started an ‘Invest in Myself’ sinking fund – guilt free money to spend on living my rich life. Money to spend on books and courses; arts and culture events within my own city. I want to start living my rich life now.

In April I reached my Coast FI milestone, a truly freeing experience. It is such a relief to know that I will reach my FIRE number in 10 years even without adding another cent to my superannuation. I learned that my WHY of FI can change – that fear no longer drives me to attain financial independence.

I learned that I enjoyed doing money savings challenges to help save extra towards my Antarctica sinking fund; that even though I didn’t think I could save any more or automate the savings, somehow I found extra money when it was fun to do so.

I learned not to lament that I don’t have time. Instead, I learned to think that I have some time and that I have the time to do all that I need to.

I learned to focus on one thing if I am overwhelmed with too many things on my agenda. And moving in the right direction in small steps is better than not moving at all.

Final thoughts

2021 was a challenging and expensive year for me, juggling home maintenance issues and the stress of working in healthcare. What a relief that it is finally over!

But it was also a year of continuous learning – of what living my rich life would look like; how important it is to find time for myself; how investing automatically pays dividends (literally 🤣); how fun it can be to save via money savings challenges.

I accomplished one goal and moved ahead in the others even if I didn’t really accomplish them.

And most of all, it was a year of not letting the damn virus beat me.