In my previous post, I wrote about increasing my income streams and desiring passive income, in particular. I define passive income as income that I make in my sleep or income produced without much effort from me.

Yes, I know – this is everyone’s dream, isn’t it?

Ah, but I am a dreamer 🙂

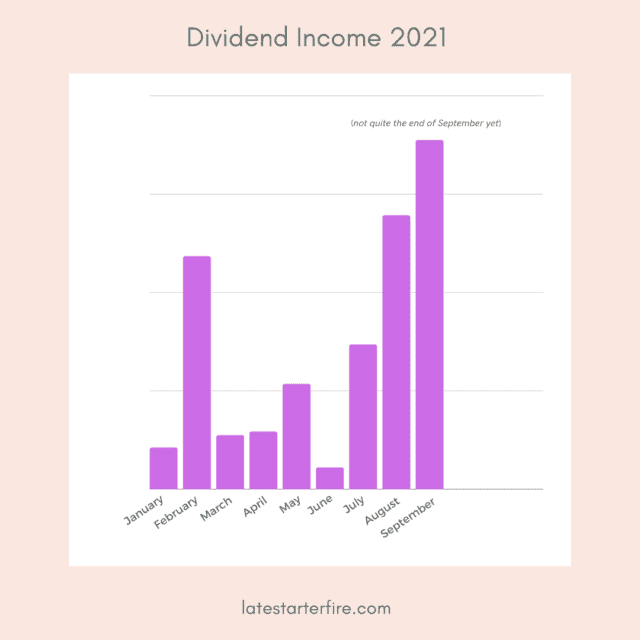

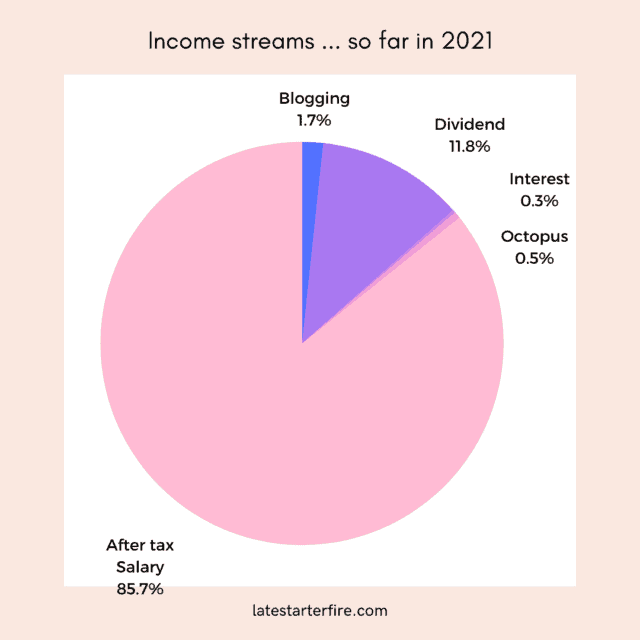

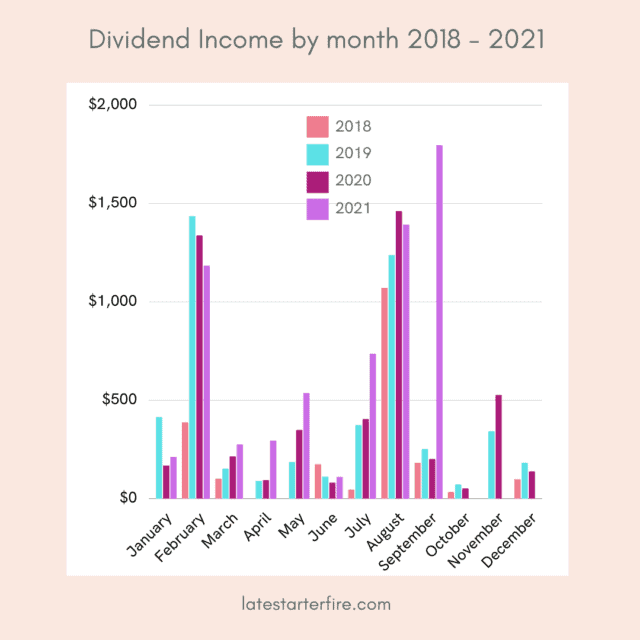

I only started to track my income recently. And to my surprise, dividends from my share portfolio was my BEST source of passive income.

Feeling Overwhelmed?

Use this FREE Checklist to start your journey to Financial Independence

What are dividends?

When we buy shares on the stock market, we are essentially buying a part (or a share) of a company that is listed on a stock exchange.

Companies listed on a stock exchange allow investors like you and me (ordinary people) to own a part of their company.

As a reward, the companies may pay us a dividend or a share of their profits.

These dividends are typically paid a few times a year.

And are paid according to how many shares you own at that time.

Reinvesting dividends

Of course once you receive your dividends, it is up to you as to how to spend the bonanza 🙂

However when you first start investing in shares, it is not quite the ‘bonanza’ – it takes time to build up your shares and for those dividends to grow. Unless you win the lottery or inherit a big lump sum of money that you can invest all at once.

If you are like me and depend on an active income stream (aka a full time job) to fund share purchases, then it will take time to slowly build that portfolio and hence, dividend income.

I set aside an amount each week from my pay to invest in shares.

But in addition to this strategy, I choose to reinvest my dividends ie I use my dividends to purchase more shares.

Therefore reinvesting my dividends is the extra fuel I use to build my portfolio.

My passive income is building my passive income.

How to reinvest your dividends

There are two ways in which to reinvest your dividends – manually or automatically.

You accumulate dividends to a certain amount and decide which share you’d like to purchase. It can be more shares of the same company or a different company. You then purchase the shares via your brokerage firm. This is the manual method.

Personally, I like the automatic method better.

Some companies offer a dividend reinvestment plan (DRP).

This means that the dividends can be used to purchase more shares in the same company. Typically there is a slight discount on the share price when compared to the market price that day.

Instead of getting a cheque or cash deposited into your nominated bank account, you will get more shares in the company.

Because dividends are paid per share, you will receive more dividends based on the increased number of shares the next time dividends are paid.

It can snowball from here.

You still need to pay tax on the dividends, regardless of whether you receive cash or use it to buy more shares. Because it is considered as income ie the ATO doesn’t care how you spend it.

Dividend reinvestment plan - how does it work?

Companies use share registries eg Computershare, Link Market Services etc to keep track of their shareholders, communication about dividends and so on.

Find out which share registry your company uses and set up online log in with the share registry. This information should be on the company website or on the paperwork which you’ll receive after your share purchase.

Log into the share registry and check if the company offers a dividend reinvestment plan.

I always elect this option if it is offered.

Ok, so how does it work?

Say, we purchase 100 shares in Company A

Twice a year in March and September, Company A pays dividends.

It announces in February that it will pay 10 cents per share in March

Woohoo, that means we’ll receive 10 cents x 100 shares = $10

On the day dividends are paid, instead of $10 hitting our bank account, it will be used to purchase more Company A shares.

For example, Company A shares cost $1 per share – we’ll receive 10 shares in March

So our total number of shares is now 110.

In September when the next dividend is payable, it will be calculated based on 110 shares.

Let’s say, Company A chooses to pay another 10 cents per share. We’ll receive 10 cents x 110 shares = $11

Then this $11 will purchase more shares at say, $1 per share which means we’ll now have an additional 11 shares and our total number of shares = 121

Of course this is a simplistic example.

But it demonstrates how your shares can grow without any effort from you besides logging into the share registry and ticking yes to the DRP.

And you haven’t contributed a single cent from your active income to grow this portfolio.

Advantages of dividend reinvestment plans

It is automatic. What can I say – I am a lazy person. Full stop.

Once it is set up, I know that every time dividends are paid, I will get more shares. And over time (sometimes a very long time), my shares are growing and I’ll receive more dividends next time. And more shares. The cycle goes on.

I don’t have to remember to reinvest those dividends.

And be tempted to use the money for other stuff while it is accumulating. This is the main benefit for me – kind of enforced savings.

The other advantage is that I don’t pay a brokerage fee for these share purchases.

Disadvantages of dividend reinvestment plans

Depending on how much the dividends are, it may not be enough to purchase a single share in the company. It is then kept until the next time dividends are paid. Depending on the number of shares you hold, the dividends paid and the share price, it may take a few dividend cycles before you can purchase a single share.

For example, one share in VAS costs $90 and you own 50 shares at the time dividends are paid. Let’s say VAS decides to pay 50 cents per share. That means you’ll receive $25 for your dividend. This is not enough to buy one share at $90.

This $25 is kept in trust until the next dividend is paid.

VAS declares that it’ll pay 60 cents per share the next quarter. You still own 50 shares. So your dividend will be $30 this time. Combined with the previous dividend of $25, you still don’t have enough to purchase a single share, assuming that the share price is still $90.

As you can see, it may take some time to increase your shares.

And those small dividend payments are not accumulating interest while they are held in trust.

Records must be kept as to purchase price – you’ll need it when it’s time to sell those shares. I use Sharesight (affiliate link*) to track my portfolio so I don’t have to worry too much here.

(*affiliate link – you get 10% off your annual payment when you sign up using my link, even if you start off with a free account)

You do need to review

While it is convenient to set and forget, you need to review at least once a year if it is still a good strategy to have a dividend reinvestment plan in place.

If the company isn’t performing, you may not want to continue investing in it. But then again, all companies have up and down times.

Because I only invest in LICs and ETFs from now on, I am comfortable with turning on DRP and leaving them turned on for the time being. All my individual shares (purchased before I knew about LICs and ETFs) are in the top 200 of the ASX and provide good dividends so I’ve left DRP turned on for the ones that do offer DRPs

Another time to consider turning off DRP will be at retirement when you can use the income to pay for living expenses.

Right now, I’m in the accumulation phase of my investment journey.

Therefore I’m more than happy to keep reinvesting those dividends and to use dividend reinvestment plans to grow my portfolio.

Will dividend income be enough in early retirement?

My 3 phase retirement plan thus far has been –

Phase 1 – build a share portfolio outside of superannuation (retirement account) and save enough cash to fund years 55 to 60 (my bridge the gap fund)

Phase 2 – access superannuation at age 60

Phase 3 – sell paid up home to fund entry into aged care facility or other advanced care when I’m really really really old

So far, phases 2 and 3 are taken care of, in that my home is paid off and by my calculation, my superannuation will be enough by the time I turn 60

That leaves phase 1.

The plan was always to sell down this share portfolio to fund the five years before Phase 2 kicks in. Because I don’t believe I have enough time to build up a big enough portfolio to generate the dividends I’d need. (The cash is to counter sequence of returns risk – I have not made any head start here, I admit)

I only have 5 more years to build this portfolio if I stick to my plan of retiring early at 55.

But you know what? I am sooooo attracted to the idea of living off my dividends.

I just feel ‘safer’ if I can use the income generated, rather than selling those assets.

So now the experiment begins!

My dividends this calendar year, up to the end of September can cover 15% of my annual living expenses. I know it’s a long way to 100% but … I am keen to see where this is heading.

Final thoughts

Reinvesting my dividends automatically via dividend reinvestment plan is the best way for me to grow my portfolio. It is in addition to investing funds monthly.

I am using my passive income to grow future passive income 🙂

I have no idea if I can eventually live off my dividends but hey, I’m going to grow my portfolio regardless.